Freedom money

As more people use less physical currency—replacing bills and coins with cards and apps—governments and central banks worldwide are increasingly able to see into our economic lives. And in authoritarian countries especially, that means an ever-expanding ability to surveil and control citizens. Digitized money becomes another way to crush dissent, and governments can better monitor accounts and transactions to spot any economic activity that threatens or displeases the state. Will cryptocurrency change this game?

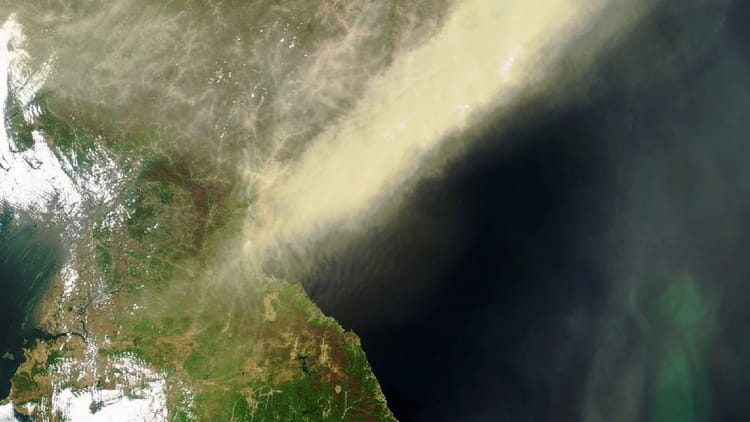

Alex Gladstein is the chief strategy officer at the Human Rights Foundation. Gladstein says pro-democracy figures and movements—such as Alexei Navalny in Russia or street protesters in Burma—can escape the financial panopticon by using Bitcoin, an encrypted, open-source digital currency. Moreover, pro-democracy organizations such as HRF—or even the U.S. State Department, or the World Bank—can now financially support pro-democracy activists by sending them bitcoins, which governments can’t easily monitor or trace to any specific user. Gladstein also sees people buying Bitcoin in countries suffering from high inflation, as it can function effectively as a savings account protected from the fluctuations in the value of national currencies. Still, creating new bitcoins requires massive amounts of energy, and the price of Bitcoin is, and will remain, highly volatile for some time—though for Gladstein, these complications are dwarfed by the cryptocurrency’s globally transformative potential …

Michael Bluhm: You refer to Bitcoin as “freedom money” or a technology of liberation, as the move away from physical money creates the opportunity for more surveillance and control. What are the dangers of using cards and apps instead of paper money and coins?