Trade War II

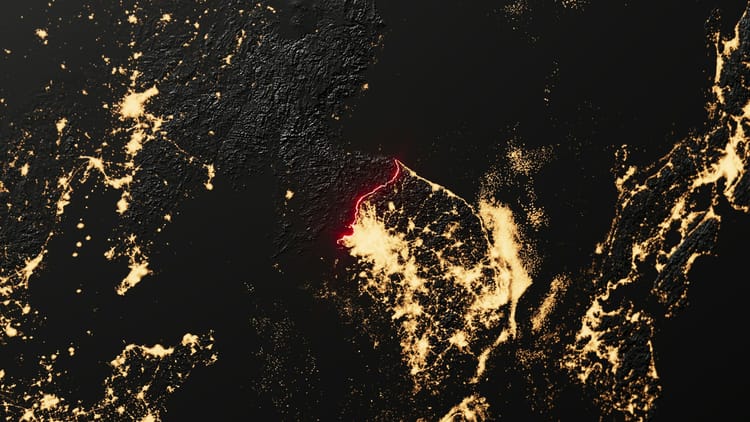

For months now, China has been flooding markets around the world with exports of low-priced, high-tech goods. On Beijing’s orders, China’s banks have primed its manufacturers to increase production dramatically—with the banks issuing about US$670 billion in new industry loans in 2023 alone, compared to $83 billion in 2019. China now spends more on its semiconductor industry than the United States and Europe combined spend on theirs. It produces around 80 percent of the world’s solar panels, nearly 60 percent of electric vehicles, and more than 80 percent of EV batteries. And now, China’s trade surplus in manufactured goods is the largest any country has recorded since the Second World War.

In Washington, the U.S. administration is responding by raising tariffs and other barriers to block Chinese companies from winning control of critical markets—and locking out U.S. firms. On May 14, the White House announced that it’s increasing tariffs on Chinese semiconductor chips and advanced batteries, and boosting the 25 percent tariff on Chinese EVs to 100 percent. It’s also strengthening tariffs on Chinese solar panels, with solar-panel imports—nearly all from China—having climbed 82 percent over the past two years, while prices have dropped 50 percent. Addressing the many forms of state support for Chinese high-tech manufacturers—government subsidies, low-cost financing, land grants, and reduced energy prices—U.S. President Joe Biden said in April, “They’re not competing. They’re cheating.”

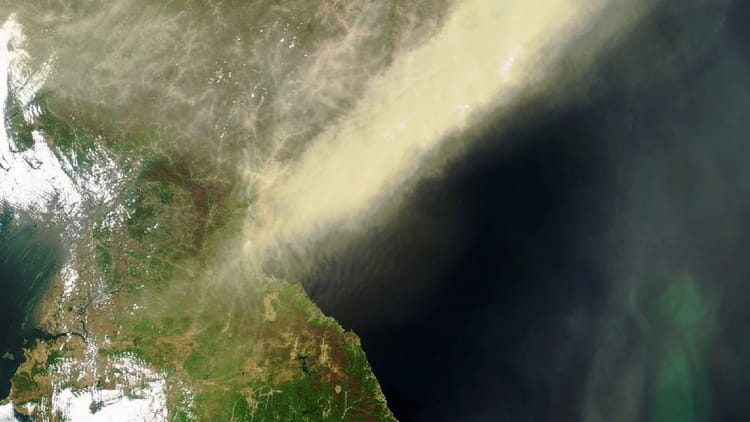

European countries have, in recent years, been reluctant to place duties on imported goods, but the EU is now taking steps to control Chinese exports. Brussels is weighing tariffs on China’s EVs and is investigating the legality of its subsidies for solar panels, steel, wind turbines, and medical devices. (In Germany and the Netherlands, solar panels have now become so cheap that people use them to build garden fences.) Xi Jinping, the general secretary of the Chinese Communist Party, visited Europe from May 5-9 partly to make the case against potential trade barriers. But after meeting Xi in Paris, Ursula von der Leyen, the president of the European Commission, said the EU was “ready to make full use of our trade-defense instruments”—adding, “Europe cannot accept market-distorting practices that could lead to deindustrialization here at home.”

Why does a new trade war seem to be breaking out between China and the West?

Alice Han is the China director at the consulting firm Greenmantle, where she leads research on China’s economy, technology, and politics. As Han sees it, Beijing is committed to pursuing continued economic growth through enormous global exports; the U.S. and the EU are committed to preventing it from dominating markets for advanced manufacturing; and electoral politics in America and Europe are meanwhile driving their leaders to take increasingly hawkish positions against China. But crucially, Han says, non-Western countries are also becoming concerned about China’s export surge, giving Washington and Brussels potential allies in their campaign to contain Beijing—not just economically but politically …

Michael Bluhm: What exactly is China doing here?